Reports YOY Revenue Growth of 57% with Gross Profit more than doubling prior year

Not for distribution to U.S. news wire services or dissemination in the United States.

Toronto, Ontario, April 21, 2022 (GLOBE NEWSWIRE) —

MiniLuxe Holding Corp. (TSXV: MNLX) today announced its financial results for the 13 weeks and 52 weeks ended December 26, 2021 (“Q4 2021” and “FY 2021”, respectively). The fiscal year of MiniLuxe is a 52-week reporting cycle ending on the Sunday closest to December 31, which periodically necessitates a fiscal year of 53 weeks. All of the fiscal years referred to in this release consist of 52 week-periods. Unless otherwise specified, all amounts are reported in U.S. dollars.

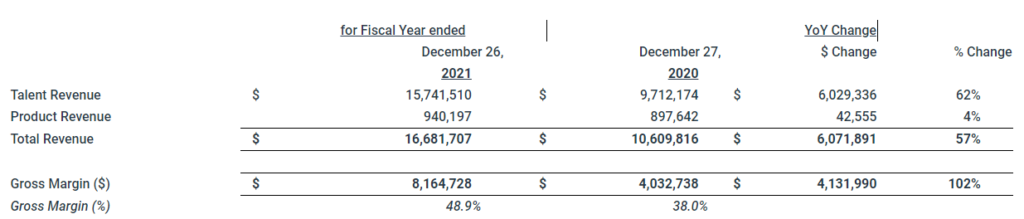

MiniLuxe is pleased to report total revenue of $16.7M in FY 2021, a nearly 60 percent increase over total revenue in the 52 weeks ended December 27, 2020 (“FY 2020”). Gross profit more than doubled, increasing from $4.0M in FY 2020 to $8.2M in FY 2021. Strong growth momentum in Q4 2021 contributed to these results. Revenue for Q4 2021 came in at $5.2M, up nearly 10% over revenue in the 13 weeks ended September 26, 2021 (“Q3 2021”) and more than 70% over revenue in the 13 weeks ended December 27, 2020 (“Q4 2020”). This performance was achieved despite various COVID-mandated closure periods that restricted operating capacity to about 60% through 2021 (relative to normal full levels of operating hours and station availability).

2021 Financial Highlights ($USD)

- Total revenue of $16.7M, a YoY increase of 57%

- Gross profit of $8.2M, representing more than a 2x increase (+102%) from prior year

- Record fleet (MiniLuxe owned studios) contribution with gross margin of 49%

- Quarter over quarter sequential growth in every 2021 quarter

- YoY growth on a like-for-like (same store sale basis) for every quarter of 2021

- Q4 2021 demonstrated record period growth surpassing Q4 2019 levels despite operating below full capacity due to Covid re-ramp. Q4 2021 revenue of $5.2M was +13 percent to Q4 2019 (pre-COVID comparable)

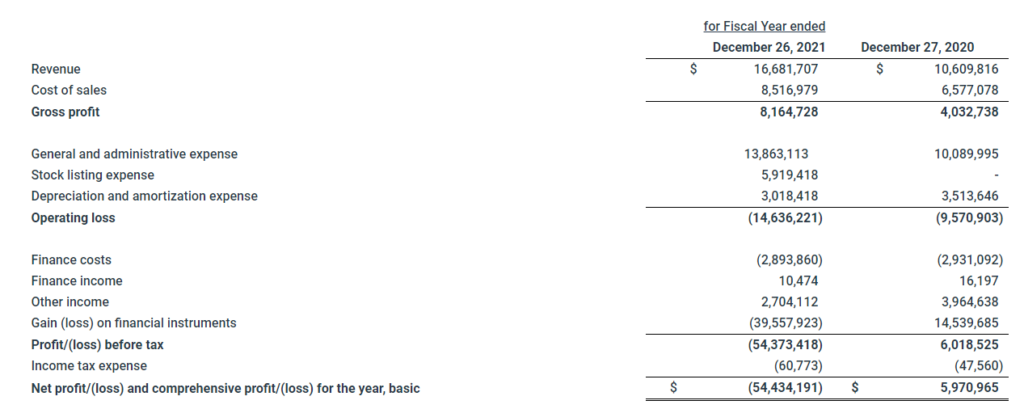

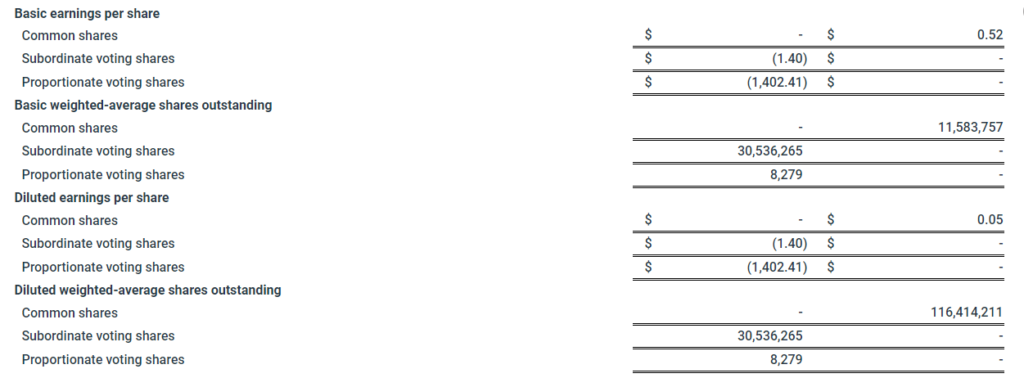

- Net loss of ($54.4M) compared to net profit of $6M for 2020 chiefly due to non-cash IFRS accounting of the fair value of redeemable preferred shares. As part of the company’s December 6th, 2021 RTO transaction, the redeemable preferred shares were cancelled

- SGA on a normalized basis (e.g., netting out one-time go-public expenses) in line with prior year. Incremental SGA attributable to reopening studios, bringing leadership talent back on board and intentionally making growth investments in digital

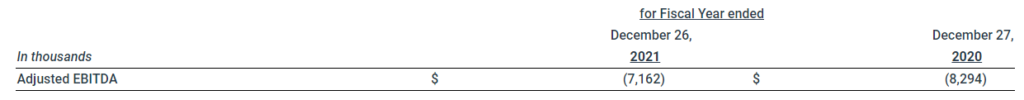

- Adjusted EBITDA1, which management views as more reflective of the business, of ($7.2M) compared to ($8.3M) for 2020

2021 Business Highlights

- Completed a Reverse Takeover Transaction resulting in the Company’s listing on the Toronto Venture Stock Exchange (the “TSXV”)

- Strong and in many cases record performance achieved despite operating at approximately 60 percent of full capacity giving confidence for further fixed cost leverage

- Added more than 35,000 new clients in 2021 on top of ~40,000 existing MiniLuxe clients

- Strong NPS scores maintained at 80+

- MiniLuxe performed more than 380,000 services, bringing the total number of services performed since MiniLuxe’s inception to nearly 3 million

- Appointed Aditi Gupta as Chief Growth Office to focus on product business

Both quarter-over-quarter and year-over-year revenue growth have accelerated continuously throughout FY 2021. This consistent revenue momentum came from the combination of increasing COVID-19 vaccination rates, implementation of efficient and agile operational practices, and growth in consumer demand for clean self-care services. Throughout the pandemic, MiniLuxe has maintained its industry-leading standards for super-hygenic and ethical nail care and waxing treatments and has stayed dedicated to utilizing only MiniLuxe-certified providers. Concurrent with the resurgence in demand, MiniLuxe has been fast-tracking recruitment and deployment of certified nail designers and waxing specialists across all channels of operations.

FY 2021 results also compare favorably on a like-for-like basis to record-setting results generated by pre-pandemic 2019 operations, which were at full capacity. As noted in the prior release of Q3 2021 results, Q3 2021 revenue exceeded that of the 13 weeks ended September 29, 2019 (“Q3 2019”) on a like-for-like basis, marking an inflection point with respect to operations since the COVID-19 pandemic began. In Q4 2021, MiniLuxe maintained this positive trend of beating the record 2019 numbers, with Q4 2021 revenue of $5.2M coming in 13% higher than that of the 13 weeks ended December 29, 2019 (“Q4 2019”) on a like-for-like basis.

“Overall, positive growth during a challenging macro-economic environment speaks to the resilience of the MiniLuxe brand and the trust and connection consumers have with the brand’s purpose: to positively promote clean self-care while empowering a diverse base of team members. We continue to march forward with our mission to be the largest empowerment and educational platform for BIPOC hourly workers,” said Tony Tjan, Chairman and Co-founder of MiniLuxe.

“We are proud of how our leadership and talent in the field navigated through 2021 and, more importantly, value their commitment towards being at the very top of the craft of what we do – elevating nail care and waxing to best-in-class self-care. The momentum of our results bodes well for the potential of our core business and several growth initiatives underway,” noted Zoe Krislock, CEO of MiniLuxe.

MiniLuxe’s talent revenue comes from MiniLuxe certified designers working either on-premises in one of MiniLuxe’s company-owned fleet studios or in off-premises channels (such as hotels, homes or offices). MiniLuxe’s digital booking application and its proprietary line of products, which are used in every service, have been key to this omni-channel strategy. In Q4 2021, monthly app downloads of MiniLuxe reached nearly triple the levels seen at the start of FY 2021. Total downloads in FY 2021 increased 123 percent over FY 2020, bringing downloads to date to over 60,000. MiniLuxe’s field teams use the app and platform to manage booking and CRM (customer relationship management), while clients use it to digitally book their MiniLuxe services and facilitate cashless payments. Investments in digital technology in FY 2021 included development of a newly redesigned e-commerce platform and an overhaul of the MiniLuxe app’s user interface; the company expects continued accretive returns from both of these initiatives. Other key investments to support growth in 2021 included expanding the senior leadership team and costs related to going public in December of 2021 on the TSXV via the largest CPC (Capital Pool Company) offering in the history of the exchange.

In FY 2021, MiniLuxe employees performed more than 380,000 self-care treatments, bringing the total number of services performed since MiniLuxe’s inception to nearly 3 million.

2021 Results

Selected Financial Measures

Non IFRS Metrics

Results of Operations

The following table outlines our consolidated statements of loss and comprehensive loss for the fiscal years ended December 26, 2021 and December 27, 2020:

Cash Flows

The following table presents cash and cash equivalents as at December 26, 2021 and December 27, 2020:

Non-IFRS Measures and Reconciliation of Non-IFRS Measures

This press release makes reference to certain non-IFRS measures used by management. These measures are not recognized measures under International Financial Reporting Standards (“IFRS”), do not have a standardized meaning prescribed by IFRS, and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of the Company’s results of operations from management’s perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of the Company’s financial information reported under IFRS. The non-IFRS measures referred to in this press release are “Adjusted EBITDA”.

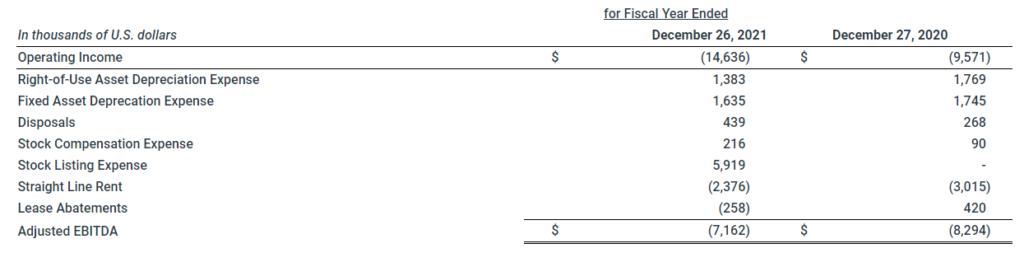

Adjusted EBITDA

Adjusted EBITDA is used by management as a supplemental measure to review and assess operating performance. Management believes Adjusted EBITDA most accurately reflects the commercial reality of the Company’s operations on an ongoing basis by adding back non-cash expenses. Additionally, the rent-related adjustments ensure that studio-related expenses align with revenue generated over the corresponding time periods.

Adjusted EBITDA is calculated by adding back fixed asset depreciation, right-of-use asset depreciation under IFRS 16, asset disposal, and share-based compensation expense to IFRS operating income, then deducting straight-line rent expenses2 net of lease abatements. Additionally, the company has added back the stock listing expense associated with the RTO transaction, as it’s largely non-cash. IFRS operating income is revenue less cost of sales (gross profit), additionally adjusted for general and administrative expenses, stock listing expense, and depreciation and amortization expense.

The following table reconciles Adjusted EBITDA to net loss for the periods indicated:

MiniLuxe, a Delaware corporation based in Boston, Massachusetts is a digital-first, socially-responsible lifestyle brand and talent empowerment platform for the nail and waxing industry. For over a decade, MiniLuxe has been setting industry standards for health, hygiene, and fair labour practices in its efforts to transform the heavily-used but highly under-regulated nail care industry. MiniLuxe looks to become one of the largest inclusionary educators and vocational employers, with a diverse, predominantly female and BIPOC workforce on its talent empowerment platform.

Today, MiniLuxe derives its revenue streams from talent (provision of nail care and waxing services) and product (sales of proprietary clean nail care products). MiniLuxe is driven by a fully-integrated digital platform that manages all client bookings, preferences, and payments and provides designers with the ability to manage scheduling and client preferences, track their performance and compensation, and access training content. Since its inception, MiniLuxe has performed nearly 3 million services. www.miniluxe.com