Reports H1 YOY Revenue Growth of 46%

August 22, 2022 18:58 ET | Source: MiniLuxe Holding Corp.

Toronto, Ontario, Aug. 22, 2022 (GLOBE NEWSWIRE) — MiniLuxe Holding Corp. (TSXV: MNLX) today announced its financial results for the 13 weeks ended June 26, 2022 (“Q2 2022”) and the 26 weeks ended June 26, 2022 (“H1 2022”). The fiscal year of MiniLuxe is a 52-week reporting cycle ending on the Sunday closest to December 31, which periodically necessitates a fiscal year of 53 weeks. All of the fiscal years referred to in this release consist of 52-week periods and all quarters referred to in this release consist of 13-week periods. Unless otherwise specified, all amounts are reported in U.S. dollars.

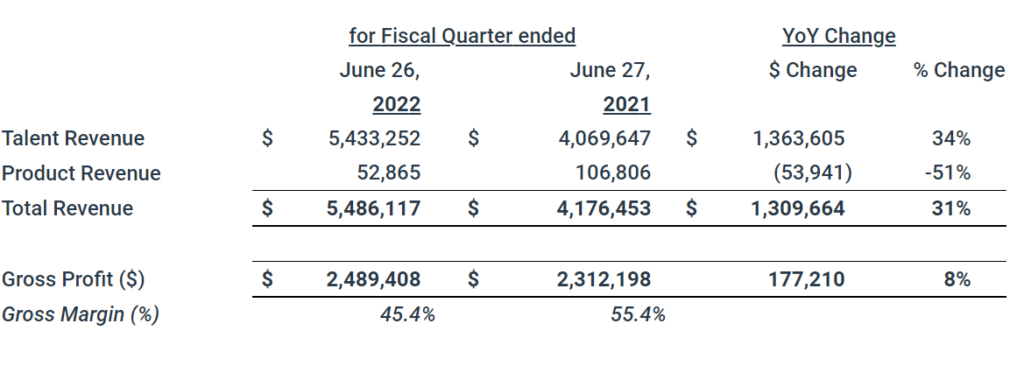

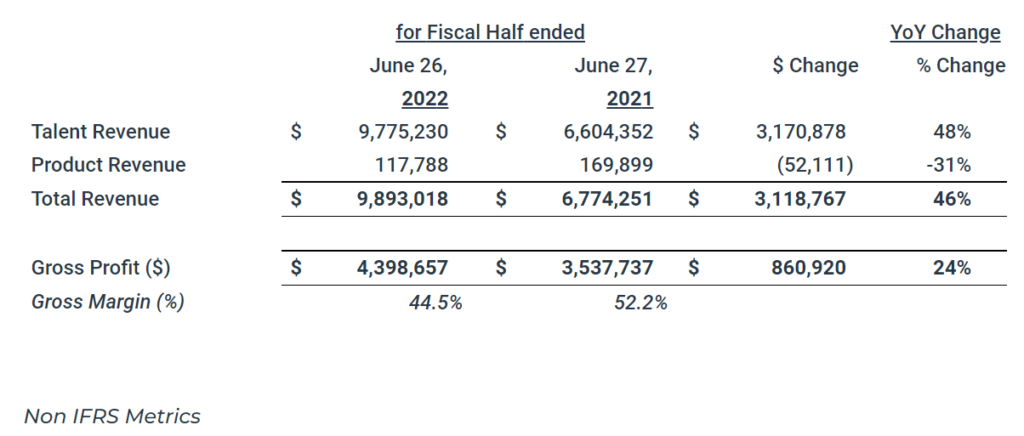

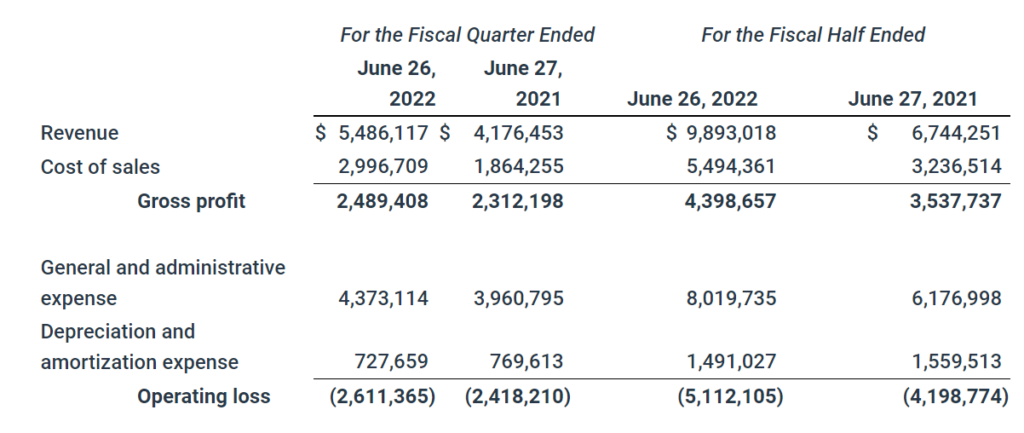

MiniLuxe is pleased to report total revenue of $5.5M in Q2 2022, a record-setting Q2 for same store sales in company history, and a 31% increase over total revenue in the 13 weeks ended June 27, 2021 (“Q2 2021”). Revenue totaled $9.9M in H1 2022, a 46% increase over total revenue in the 26 weeks ended June 27, 2021 (“H1 2021”). Gross profit increased by 8% from $2.3M in Q2 2021 to $2.5M in Q2 2022 and increased by 24% from $3.5M in H1 2021 to $4.4M in H1 2022. This performance was achieved despite still being in a post-covid re-ramp and amid well-known macro-economic factors of labor shortages, supply chain challenges, and inflation.

MiniLuxe continues to positively transform the nail and waxing industry through its quality and clean selfcare services using fair and transparent labor practices and a talent empowerment platform. The company’s digital empowerment platform allows nail designer and waxing specialist talent to book and manage clients both in MiniLuxe’s owned and operated studios and across off-premise locations (on demand MiniLuxe Anywhere services). Investments in CAPEX and SG&A in Q2 were attributable to further development of the digital talent platform, expansion to new talent dense markets, and the acceleration of the company’s talent and product revenue channels.

Q2 2022 Financial Highlights ($USD)

- Total revenue of $5.5M, a YoY increase of 31% and sequential quarter growth of 24%

- Gross profit of $2.5M, an 8% increase from prior year and sequential quarter growth of 30%

- Strong Q2 2022 fleet revenue of $5.4M demonstrated 12% growth on Q2 2019 on a like-for-like studio basis (pre-COVID comparable)

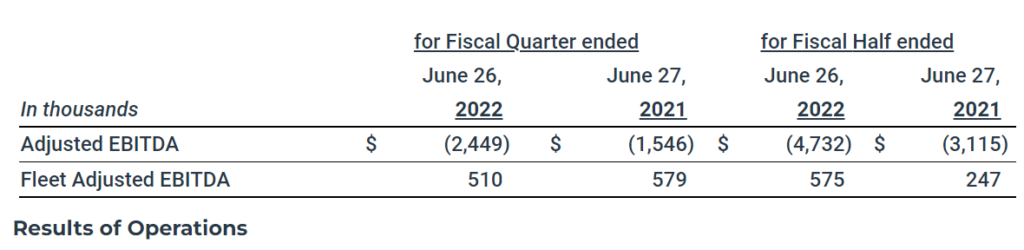

- Fleet Adjusted EBITDA for Q2 2022 at $510K down slightly from Q2 2021 of $579K, but up 677% from Q1 2022 of $66K

- Full Company Adjusted EBITDA1 of ($2.4M) compared to ($1.5M) for Q2 2021 attributable to SG&A increase to fund planned growth initiatives including strategic M&A spend

H1 2022 Financial Highlights ($USD)

- Total revenue of $9.9M, a YoY increase of 46%

- Gross profit of $4.4M, a 24% increase from prior year

- H1 2022 demonstrated period growth surpassing H1 2019 levels despite COVID-19 related demand issues resulting from the Omicron variant. $9.7M fleet revenue was +10% to H1 2019 on a like-for-like studio basis (pre-COVID comparable)

- Fleet Adjusted EBITDA2 for H1 2022 at $575K up 133% from H1 2021 of $247K, as fleet operations continue to improve (especially in Q1 2022 v. Q1 2021) and demand grows YoY

- Fleet Adjusted EBITDA2 normalized for price increase and lease abatements results in H1 2022 +294% on H1 2021

- Full Company Adjusted EBITDA2 of ($4.7M) compared to ($3.1M) for H1 2021 attributable to SG&A increase to fund growth initiatives

Q2 and H1 2022 Business Highlights

- Q2 weekly appointment counts surpassed highest levels seen during 2021 Q4 holiday season by 12%

- Added 9.1K new fleet customers in Q2 leading to 12% growth v. Q1 2022 demonstrating growing demand for clean, high quality selfcare services

- Accelerated talent acquisition efforts positively resulted in a 20% increase in weekly staffed hours YoY and a 6% MoM increase through Q2. Continued focus on increasing staffing capacity and weekly staffed hours as a KPI remain central to taking advantage of strong and latent demand

- Digital platform metrics continued to show positive traction. Overall MiniLuxe experienced 24% growth of new e-commerce customers and Q2 MiniLuxe app downloads grew by 8% v. Q1 2022 due to revamped booking and purchasing mobile experience with total app downloads nearing 70K

- Introduced MiniLuxe product & services to the Canadian market through Muskoka summer popup and launch of Canadian e-commerce website

- Announced Paintbox acquisition to expand MiniLuxe’s service range capability. Paintbox brings MiniLuxe their leading brand in premium nail art & design, proprietary IP in their iconic look-book, and 260K new social followers. The acquisition accelerates MiniLuxe’s product and content strategy and opportunities for new nail art certification standards for nail talent. It marks both an entry into the New York market and management’s intention to continue to use MiniLuxe’s brand strength and public currency for accretive growth M&A

Q2 2022 revenue growth v. Q2 2021 is attributable to continued increases in consumer demand—evidenced by rising weekly average appointment counts—and a relentless focus on talent acquisition and retention leading to continued increases in weekly average staffed hours. While the product channel revenue did not meet expectations, growth signals include 24% e-commerce customer growth v. Q2 2021 and a 240% increase in e-commerce traffic v. Q2 2021. The company remains confident in its investments in its digital platform and vision to serve nail-care, waxing and other self-care content, commerce and community for its user base (demand side) and for designer talent (supply side) comprehensive infrastructure-as-as service. Customers come to MiniLuxe to find and book their self-care services and talent providers come to MiniLuxe to build their businesses with those clients leveraging MiniLuxe’s standards, brand, and platform. MiniLuxe’s core strategy remains to connect this two-sided marketplace and its supply and demand by owning the industry’s leading brand and digital platform, expanding its owned-and-operated omnichannel ecosystem and driving innovation and expanded self-care services and products through a strong base of organic growth complemented by targeted accretive acquisitions.

“This quarter marked continued focus on growing our supply capacity to take advantage of untapped demand and focused corporate development efforts. Our first acquisition in Paintbox brings to the MiniLuxe family an iconic and leading industry brand, incredible people and our first step towards complementing high quality organic growth with M&A opportunities for leading nail-care and self-care brands and talent.” said Tony Tjan, Chairman and Co-founder of MiniLuxe.

“We directly attribute these strong YOY results to our talent base which has been the core revenue driver of the MiniLuxe business. Despite a challenging supply environment, the company has seen a tremendous uplift in our key business metric of weekly staffed hours through various acquisition channels. We anticipate strong continued momentum to further capitalize on the growing demand for hygienic self-care services and products,” remarked Zoe Krislock, CEO of MiniLuxe.

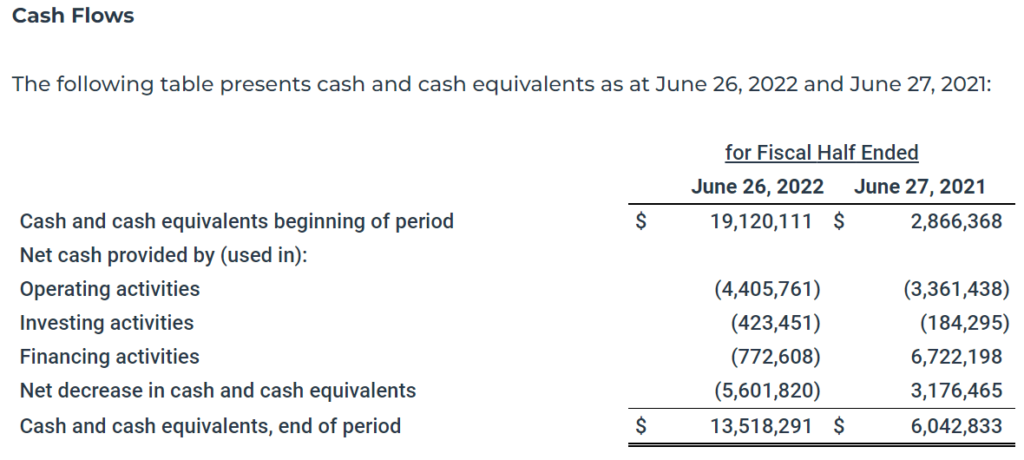

Q2 and H1 2022 Results

Selected Financial Measures

MiniLuxe notes a change in accounting policy to more accurately reflect revenue generated from talent and product revenue streams to more align with how management analyzes the Company. The change has been retrospectively applied and does not have any effect on revenue recognition principles utilized or total overall revenue recognized.

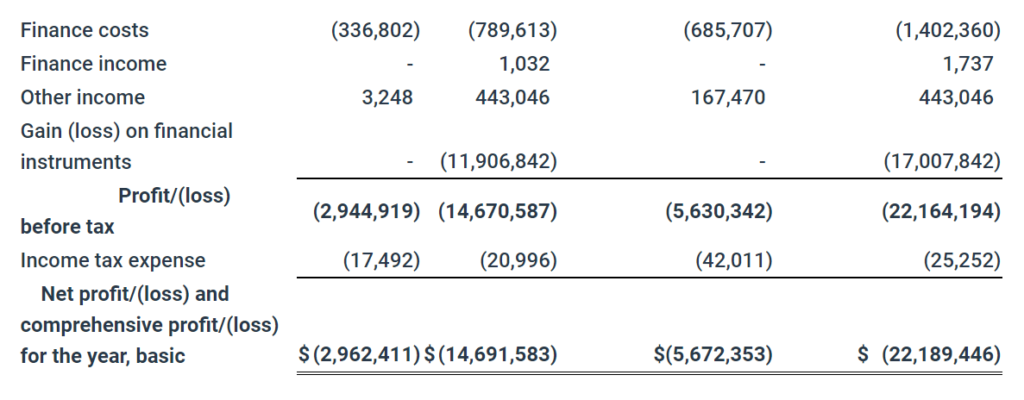

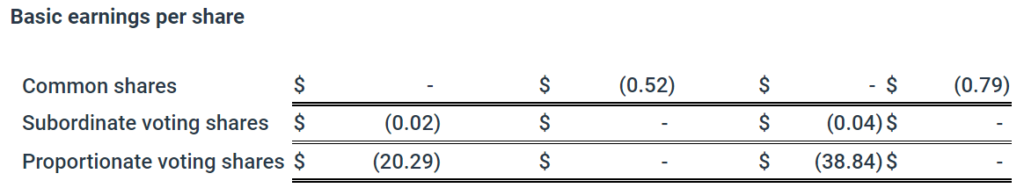

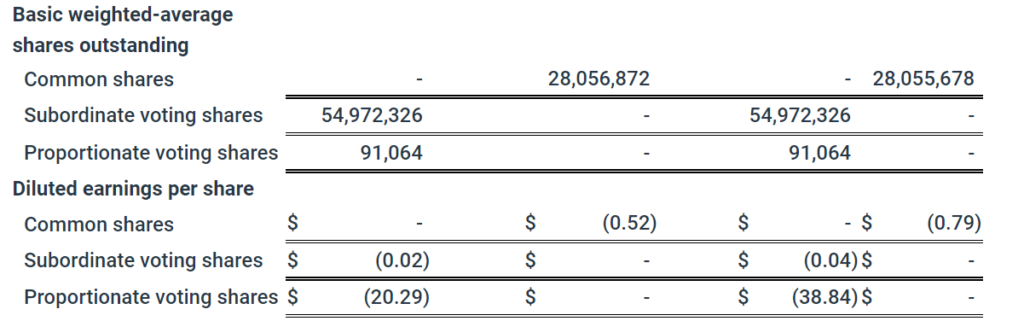

The following table outlines our consolidated statements of loss and comprehensive loss for the fiscal quarters and fiscal halves ended June 26, 2022 and June 27, 2021:

Non-IFRS Measures and Reconciliation of Non-IFRS Measures

This press release references certain non-IFRS measures used by management. These measures are not recognized measures under International Financial Reporting Standards (“IFRS”), do not have a standardized meaning prescribed by IFRS, and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of the Company’s results of operations from management’s perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of the Company’s financial information reported under IFRS. The non-IFRS measures referred to in this press release are “Adjusted EBITDA” and “Fleet Adjusted EBITDA”.

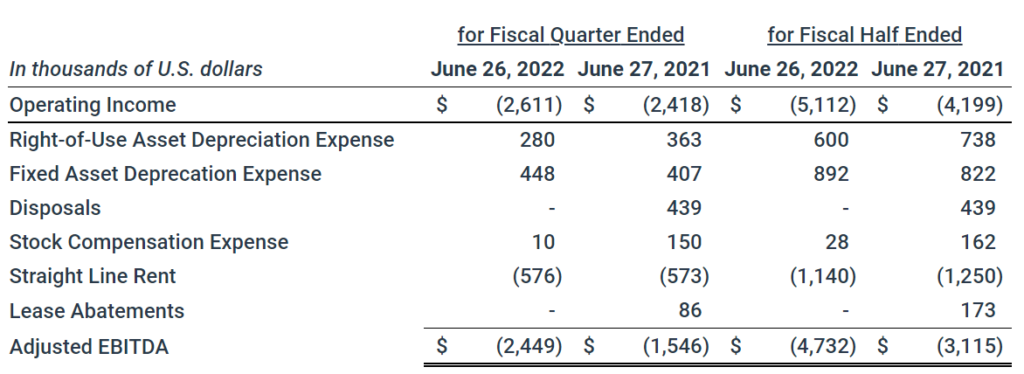

Adjusted EBITDA

Adjusted EBITDA is used by management as a supplemental measure to review and assess operating performance. Management believes Adjusted EBITDA most accurately reflects the commercial reality of the Company’s operations on an ongoing basis by adding back non-cash expenses. Additionally, the rent-related adjustments ensure that studio-related expenses align with revenue generated over the corresponding time periods.

Adjusted EBITDA is calculated by adding back fixed asset depreciation, right-of-use asset depreciation under IFRS 16, asset disposal, and share-based compensation expense to IFRS operating income, then deducting straight-line rent expenses3 net of lease abatements. IFRS operating income is revenue less cost of sales (gross profit), additionally adjusted for general and administrative expenses, and depreciation and amortization expense.

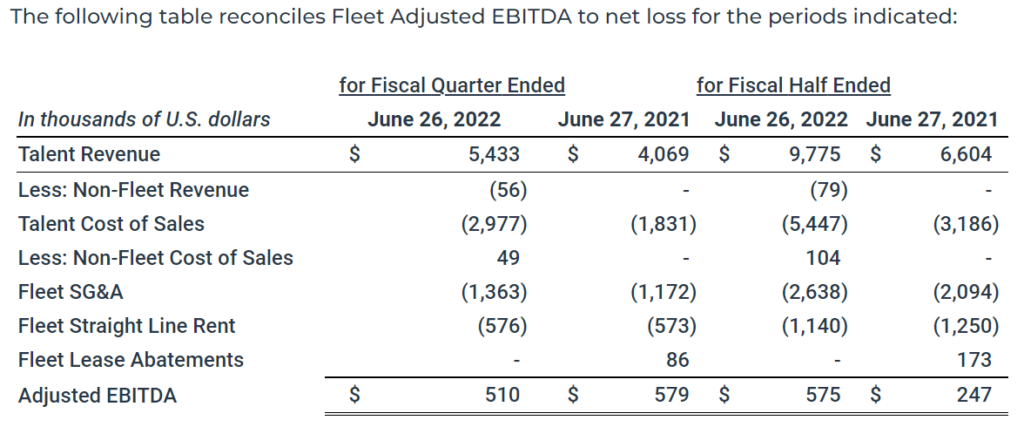

The Company also uses Fleet Adjusted EBITDA to evaluate its fleet performance. This metric is calculated in a similar manner, starting with Talent revenue and adjusting for non-fleet Talent revenue and cost of sales, further adjusted by fleet SG&A and finally subtracting the same straight line rent expense used in the full company Adjusted EBITDA (as the fleet holds all real estate leases). The Company believes that this metric most closely mirrors how management views the fleet portion of the business.

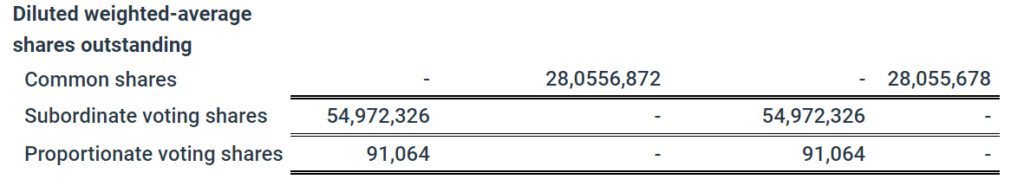

The following table reconciles Adjusted EBITDA to net loss for the periods indicated:

MiniLuxe, a Delaware corporation based in Boston, Massachusetts is a digital-first, socially-responsible lifestyle brand and talent empowerment platform for the nail and waxing industry. For over a decade, MiniLuxe has been setting industry standards for health, hygiene, high quality services, and fair labor practices in its efforts to transform the nail care and waxing industry. Underlying MiniLuxe’s mission and purpose is to become one of the largest inclusionary educators and employers of diverse self-care professionals across our omni-channel ecosystem and talent empowerment platform.

Today, MiniLuxe derives its revenue streams from talent (provision of nail care and waxing services) and product (sales of proprietary clean nail care products). MiniLuxe is driven by a fully-integrated digital platform that manages all client bookings, preferences, and payments and provides designers with the ability to manage scheduling and client preferences, track their performance and compensation, and access training content. Since its inception, MiniLuxe has performed nearly 3 million services. www.miniluxe.com