Reported figures in U.S. Dollars

Achieved 29% YoY Revenue Growth, Nearly 100% From Existing Core Business

Toronto, Ontario – April 27, 2023 – MiniLuxe Holding Corp. (TSXV: MNLX) today announced its financial results for the 53 weeks ended January 1, 2023 (“FY2022”). The fiscal year of MiniLuxe is a 52-week reporting cycle ending on the Sunday closest to December 31, which periodically necessitates a fiscal year of 53 weeks. FY2022 consisted of a 53-week period while all other fiscal years referred to in this release consist of 52-week periods. Unless otherwise specified, all amounts are reported in U.S. dollars.

MiniLuxe is pleased to announce robust double-digit growth on a same studio basis from the core MiniLuxe studios. The company demonstrated continued momentum towards its vision of transforming the nail care and waxing industry through clean and sustainable practices, proprietary products and by empowering beauty professionals to book and manage services through its digital platform. In the year of 2022, MiniLuxe added over 250 licensed and MiniLuxe certified beauty professionals to its digitally-driven talent empowerment platform, setting records in staffing, and further enabling an expanded set of revenue channels for MiniLuxe- certified nail and waxing professionals to perform their services. MiniLuxe also achieved an important milestone in 2022 with the acquisition of the Paintbox brand, which is actively in post-merger integration. Paintbox is a leader in premium nail art and design, with a nail art studio located in New York City and proprietary IP related to its iconic nail art looks, which have been showcased across the fashion industry and in major brand partnerships. MiniLuxe believes there is significant untapped value in the Paintbox brand and that the MiniLuxe infrastructure will provide further opportunities for fixed cost leverage as we integrate.

MiniLuxe’s business model consists of 1) Talent services revenue generated from nail care and waxing/esthetic, and 2) Revenue generated from the Company’s premium, proprietary nail and self-care Product portfolio. The Company’s services revenue is delivered across an ecosystem of 20 fully-owned and operated MiniLuxe / Paintbox fleet of studios (and 1 training center) as well as “off-premises” delivery (at residential, offices, and hospitality venues and events) through its MiniLuxe Anywhere offering. In addition to services, MiniLuxe is building and selling a line of proprietary nails, waxing, and skin / body care products. MiniLuxe differentiates its product offerings by committing to clean, sustainable and better-for-you products that have been time- and client-tested across 3+ million services performed. MiniLuxe and Paintbox products are sold through MiniLuxe team members who are all product ambassadors, wholesale channels, and most important online DTC (direct-to-consumer) e-commerce.

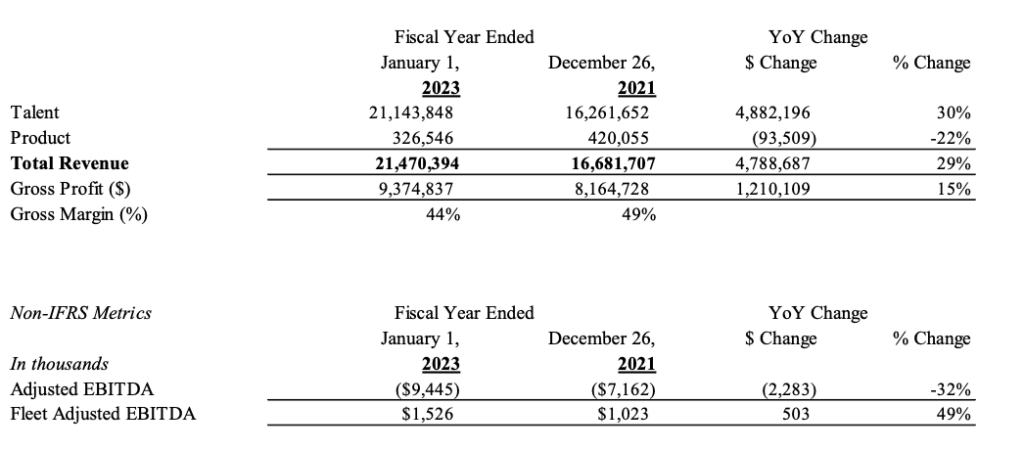

The Company achieved strong year-over-year growth as FY2022 revenue increased nearly 30% versus FY2021 at $21.5M (all figures in US dollars) with gross profit of $9.4M, an increase of 15% year-over-year (“YoY”). Organic growth from this same MiniLuxe studio fleet made up 96% of 2022 total revenue, through the operational excellence and optimization of units. To provide further context, MiniLuxe same studio sales in 2022 were 13% higher than 2019 (pre-pandemic) comps. Considering lingering impacts of the pandemic (e.g., Delta variant in Q1 2022) along with the labor and inflation issues peaking in Q2 and Q3 2022), the studios still operated with some limitations on operating hours and reduced capacity, providing further confidence in the brand’s resiliency, the quality and stickiness of the Company’s Loyal Clients (those who visit MiniLuxe on at least a monthly basis), and management’s ability to be agile against volatile times.

Focus remains on increasing the number of certified nail designers and waxing professionals who are active on the MiniLuxe platform, which has been key to creating a competitive moat and marketplace between the “supply side” of certified beauty professionals with the “demand side” of the Company’s client members.

During 2022, MiniLuxe continued to extend its engagement with a larger and diversified customer base as evidenced by servicing over 280K appointment hours, +23% from FY2021 with Q4 2022 MiniLuxe same studio appointment hours coming in 9% higher than 2019 (pre-pandemic) levels. The Company is also seeing record levels of Loyal Clients and an increasing share of high margin premium services as a percentage of all services. MiniLuxe continues to take a data-driven approach towards how best to optimize and match supply and demand. The focus on growing and aggregating supply-side talent has led to a 30%+ growth in staffed hours YoY, with a particular focus on peak days (Thursday-Sunday), as such days tend to have the highest demand.

MiniLuxe has set a goal of achieving positive free cash flow generation in 2024 with existing capital on hand. While macro-economic factors including labor shortages, changes in credit availability/ terms and inflation remain impactful, MiniLuxe continues to see growth in market supply and demand. As an example, relative to examples of other self-care service brands, MiniLuxe averaged >10% higher annual revenue generated per nail designer1, implying premium economics as we further optimize operations. In addition to the expected continued growth of on-premises studio fleet business, additional growth is expected to come from high conviction and financially sound, strategic investments, including the brand’s new growth channels of its off- premises MiniLuxe Anywhere and product (e-commerce and wholesale) channels, MiniLuxe is well positioned to achieve its strategic goals and vision to be the leader in the industry. The Company’s new growth channels have started to demonstrate positive green shoots with proof-of-concept tests of the digital MiniLuxe Anywhere offering.

“The 2022 year was a strong transition year as the first full year of being a public company and our first nearly fully reset (nearly fully open) year post-Covid. The Company has a twin focus on defending and growing the core base business of on-premises services (i.e. MiniLuxe studio business), which continues to compound with positive contribution, while playing offense with several tests and initiatives with our new growth opportunities with MiniLuxe Anywhere and MiniLuxe/Paintbox Products.” said Tony Tjan, Executive Chairman and Co- founder of MiniLuxe.

“MiniLuxe is pleased to report continued double digit growth for 2022 and taking advantage of the momentum going into 2023. Covid represented both a challenge and an opportunity. As we move out of Covid, we are proud of how we optimized and grew the business in the face of one of history’s most difficult moments for consumer on-premises services and now with a reset competitive landscape feel that much stronger about opportunities for new channels of growth and M&A,” said Zoe Krislock, CEO of MiniLuxe

FY2022 Financial Highlights ($USD)

• Total revenue of $21.5M, a YoY increase of 29%

• Gross profit of $9.4M, a 15% increase from prior year

• 96% of total revenue growth generated organically from the same studios that existed at the beginning of

the year, with even more room for further organic growth and optimization in the future

• FY2022 Fleet Adjusted EBITDA2 at $1.5M up 49% from FY2022

• Full Company Adjusted EBITDA2 of ($9.4M) compared to ($7.2M) for FY2021; increased loss

attributable to investment in SG&A to fund planned growth initiatives

FY2022 Business Highlights

• FY2022 weekly appointment hours increased 21% YoY and surpassed highest previous quarterly record by 5%. FY2022 operating hours were 33% lower than FY2019 (pre-COVID) due to continued impact of the pandemic. However, in Q4 2022 we still saw total appointments increase 10% from Q4 2019, leading to higher profitability. As previously discussed, MiniLuxe believes there is substantial additional upside in the current fleet of studios

• MiniLuxe’s Loyal Client base (as previously defined) grew quarter over quarter to exceed 2019 pre- pandemic levels, highlighting growing predictable and recurring revenue base within the Talent segment

• Despite a challenging supply environment, MiniLuxe’s talent acquisition and retention focus resulted in record levels of staffed hours and peak day staffing hours, both reflecting strength on a YoY and QoQ basis. These metrics are central business KPIs as the Company ramps staffing to meet demand for the spring and summer season

• After adjusting to changing consumer purchasing behavior post-COVID, MiniLuxe’s e-commerce product business achieved QoQ growth of +180% from Q3 to Q4 2022, and +48% YoY growth by Q4 2022

• Launched a series of MiniLuxe Anywhere initiatives offering off-site, clean nail-care services. Early results indicate future success at scale from at-home and corporate event bookings. Two-sided marketplace booking platform for nail entrepreneurs has expanded the supply pool of talent across businesses.

• Completed Paintbox acquisition and began post-merger integration of New York studio and Paintbox product line into MiniLuxe

• Subsequent Events: In January of 2023, the Company received a refundable payroll tax credit, the Employee Retention Credit, under the Coronavirus Aid, Relief, and Economic Security (CARES) Act in the amount of $3,158,548. The Employee Retention Credit is a government funded tax credit established by the United States federal government under the CARES Act to help eligible employer that presented a decline in business due to the COVID-19 pandemic and related shutdowns. The Company will recognize the entirety of the Employee Retention Credit as other income in Q1 2023

FY 2022 Results

Selected Financial Measures

MiniLuxe notes a change in accounting policy to more accurately reflect revenue generated from talent and product revenue streams to more align with how management analyzes the Company. The change has been retrospectively applied and does not have any effect on revenue recognition principles utilized or total overall revenue recognized.

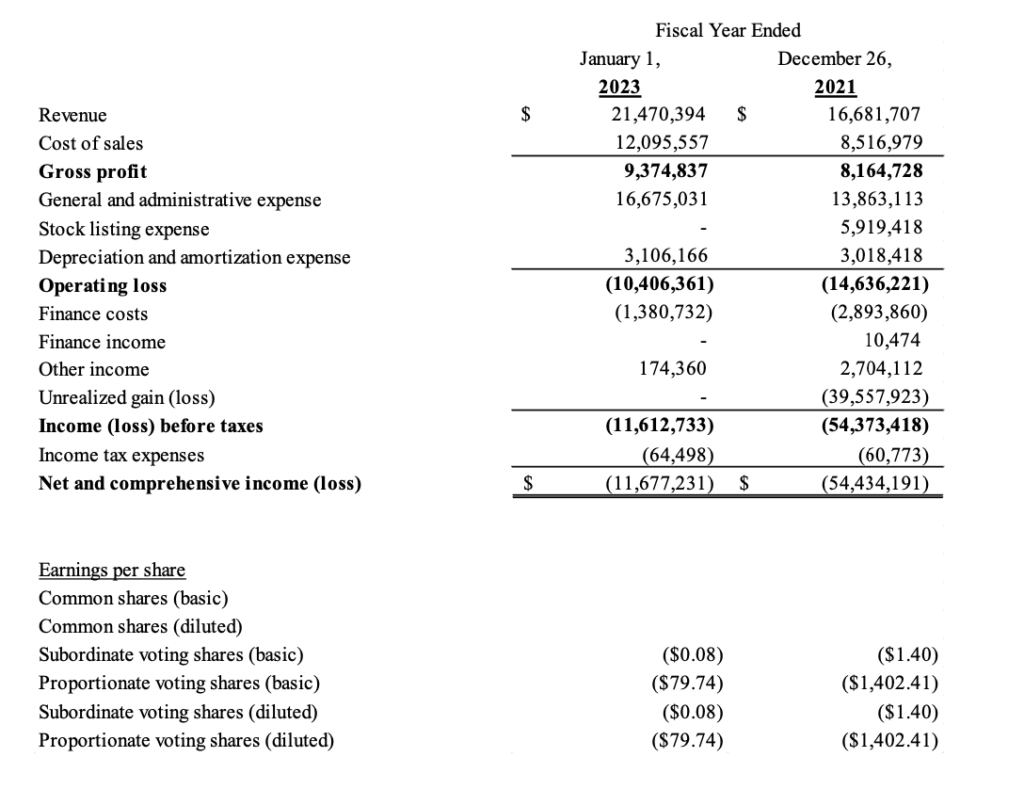

Results of Operations

The following table outlines the consolidated statements of loss and comprehensive loss for the fiscal quarters and fiscal periods ended January 1, 2023 and December 26, 2021:

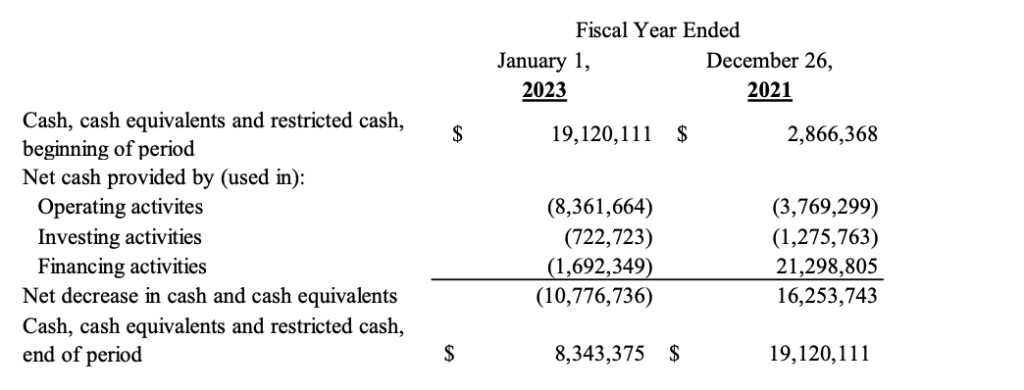

Cash Flows

The following table presents cash and cash equivalents as at January 1, 2023 and December 26, 2021:

Subsequent to FY2022, in January of 2023, the Company received a refundable payroll tax credit, the Employee Retention Credit, under the Coronavirus Aid, Relief, and Economic Security (CARES) Act in the amount of $3,158,548. The Employee Retention Credit is a government funded tax credit established by the United States federal government under the CARES Act to help eligible employer that presented a decline in business due to the COVID-19 pandemic and related shutdowns. The Company will recognize the entirety of the Employee Retention Credit as other income in Q1 2023.

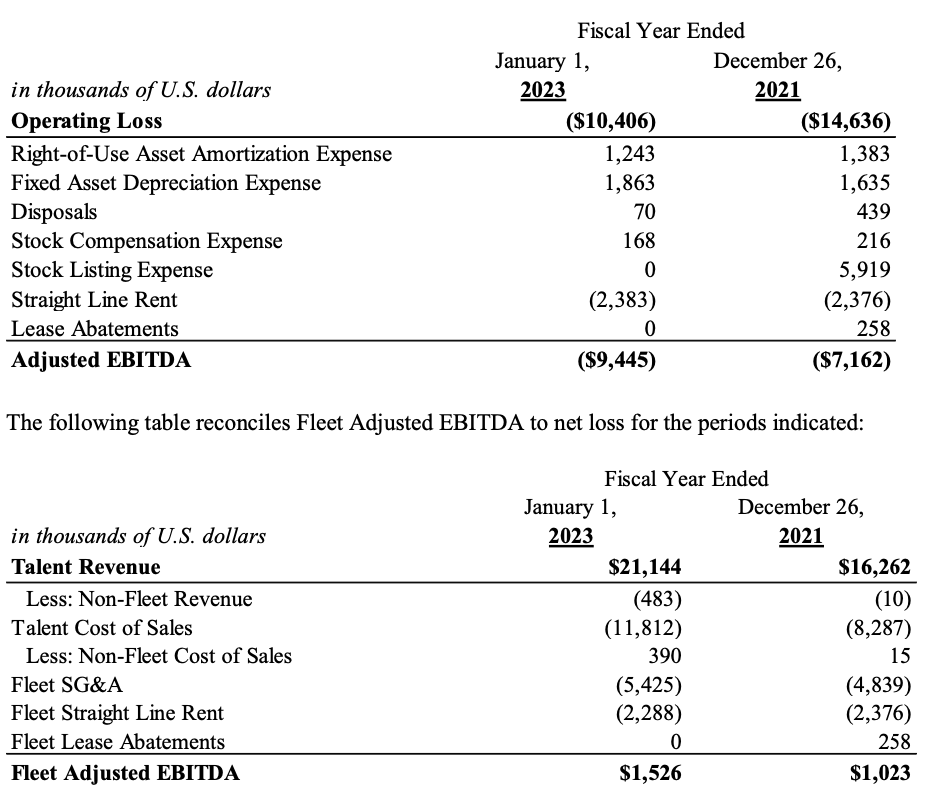

Non-IFRS Measures and Reconciliation of Non-IFRS Measures

This press release references certain non-IFRS measures used by management. These measures are not recognized measures under International Financial Reporting Standards (“IFRS”), do not have a standardized meaning prescribed by IFRS, and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of the Company’s results of operations from management’s perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of the Company’s financial information reported under IFRS. The non-IFRS measures referred to in this press release are “Adjusted EBITDA” and “Fleet Adjusted EBITDA”.

Adjusted EBITDA

Adjusted EBITDA is used by management as a supplemental measure to review and assess operating performance. Management believes Adjusted EBITDA most accurately reflects the commercial reality of the Company’s operations on an ongoing basis by adding back non-cash expenses. Additionally, the rent-related adjustments ensure that studio-related expenses align with revenue generated over the corresponding time periods.

Adjusted EBITDA is calculated by adding back fixed asset depreciation, right-of-use asset depreciation under IFRS 16, asset disposal, and share-based compensation expense to IFRS operating income, then deducting straight-line rent expenses3 net of lease abatements. IFRS operating income is revenue less cost of sales (gross profit), additionally adjusted for general and administrative expenses, and depreciation and amortization expense.

The Company also uses Fleet Adjusted EBITDA to evaluate its fleet performance. This metric is calculated in a similar manner, starting with Talent revenue and adjusting for non-fleet Talent revenue and cost of sales, further adjusted by fleet SG&A and finally subtracting the same straight line rent expense used in the full company Adjusted EBITDA (as the fleet holds all real estate leases). The Company believes that this metric most closely mirrors how management views the fleet portion of the business.

The following table reconciles Adjusted EBITDA to net loss for the periods indicated:

About MiniLuxe

MiniLuxe, a Delaware corporation based in Boston, Massachusetts is a digital-first, socially-responsible lifestyle brand and talent empowerment platform and marketplace [let’s consider] for the nail and waxing industry. For over a decade, MiniLuxe has been setting industry standards for health, hygiene, high quality services, and fair labor practices in its efforts to transform the nail care and waxing industry. Underlying MiniLuxe’s mission and purpose is to become one of the largest inclusionary educators and employers of diverse self-care professionals across an omni-channel ecosystem and talent empowerment platform.

Today, MiniLuxe derives its revenue streams from nail care and waxing services across an omni-channel ecosystem of on premise with company-owned studios and partnerships and off-premise on-demand services. The company also develops and sells a proprietary retail and e-commerce line of clean nail care and waxing products that are also used in MiniLuxe services. MiniLuxe is driven by a fully-integrated digital platform that manages all client bookings, preferences, and payments and provides designers with the ability to manage scheduling and client preferences, track their performance and compensation, and access training content. Since its inception, MiniLuxe has performed nearly 3 million services. www.miniluxe.com

For further information

Anthony Tjan

Executive Chairman, MiniLuxe Holding Corp. atjan@miniluxe.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

1MiniLuxe nail designers in 2022 averaged $94K in revenue generation on a full-time equivalent basis), whereas European Wax Center (NASDAQ: EWCZ) targets $80K per tech in revenue per their 2022 Annual Report (Target Year 5 Revenue $1M with Target 13 Techs/Unit)

2Please refer to “Non-IFRS Measures and Reconciliation of Non-IFRS Measures” sections of this press release.

3Straight-line rent expense for a given payment period is calculated by dividing the sum of all payments over the life of the lease (the figure used in the present value calculation of the right-of-use asset) by the number of payment periods (typically months). This number is then annualized by adding the rent expenses calculated for the payment periods that comprise each fiscal year. For leases signed mid-year, the total straight-line rent expense calculation applies the new lease terms only to the payment periods after the signing of the new lease.